Posted on 21 November 2019 by Soo-hyun Lee

The views expressed in this publication are those of the authors and do not necessarily represent those of the Agenda 2030 Graduate School or Lund University. The present document is being issued without formal editing.

Policies meant to push welfare gains to the public interest through, for instance, serving environmental justice, can face countervailing circumstances that may result in welfare losses that discount the value of the policy itself. Development economics points to a wide array of causal factors behind this, such as information asymmetries. Gough amongst others reflect on this complexity in sustainable development policy making, which the author humbly imposes meaningful interlinkages with select analytical approaches in international law and development economics.

First, what are these countervailing circumstances and how might they discount the welfare gains of environmental justice policy? Gough (2011) identifies numerous technical limitations, such as the rebound effect and unaccounted emissions contributions arising from offshore production in domestic emissions stocktaking. A more philosophical and normative circumstance is a perceived inefficiency and inequity of public policy when viewed from a cross sectoral approach between addressing both the concerns of climate change and those of social justice. One attempt to address this concern has been green growth, which was an attempt to decouple negative externalities, such as a worsening state of environmental justice, from economic growth. The problem with this view is that it does not promote a “strong” sustainability, which must be based on a sense of mutuality, collective interest and the common good. To strengthen the sustainability of policy, integration between these different spheres of justice is necessary to create a steady-state equilibrium of environmental and social welfare, amongst other, concerns.

The consequence of a lacking steady-state and policy integration can be, inter alia, a double injustice. Gouge (2013) flags, for instance, the particular sensitivity to the impacts of both climate change and the costs of its mitigation to entities (both countries and individuals) at higher risk. This includes States at higher risk to the effects of climate change such as desertification and rising sea levels, as well as due to the lack of economic resilience and disparities at the household, firm and macroeconomic levels. As climate and environmental risk factors deepen, “green poverty” also poses greater magnitudes of threats, thus calling for a “co-benefit” approach that attempts to shape a win-win approach to environmental and socioeconomic policy.

In addition to comparisons drawn between the co-benefit and upstream approaches to sustainable development policy, there is significant value added in a horizontal and cross-sectoral endeavour. In international economic governance, for instance, the grounds for such projects are increasingly fertile. Concepts, concerns and standards related to sustainable development are becoming inseparable to those in international economic law, financial markets and corporate governance. Over the past three to four years, the penultimate of these has been attracting particularly reverberant attention with the growth of environmental, social and governance (ESG) investments and other “green” standards for financial instruments, such as green bonds.

In many ways, the maturation and wide use of these standards within the private sector has been pushing forward a close union between sustainable development, insofar is captured by the UN Sustainable Development Goals, and financial markets. Yet this union and the expedited nature of its implementation has also been the subject of poignant controversy. For instance, from the latter half of 2019, portfolio investments in funds that value in the magnitude of billions of USD have been enjoying the benefits of the ESG label only to later be revealed to have included investments in firearms manufacturers and deep water drilling for hydrocarbon resources. Needless to say, this sparked existential self-reflection for ESG portfolios and hit a nerve for investors seeking financial gains with moral equanimity.

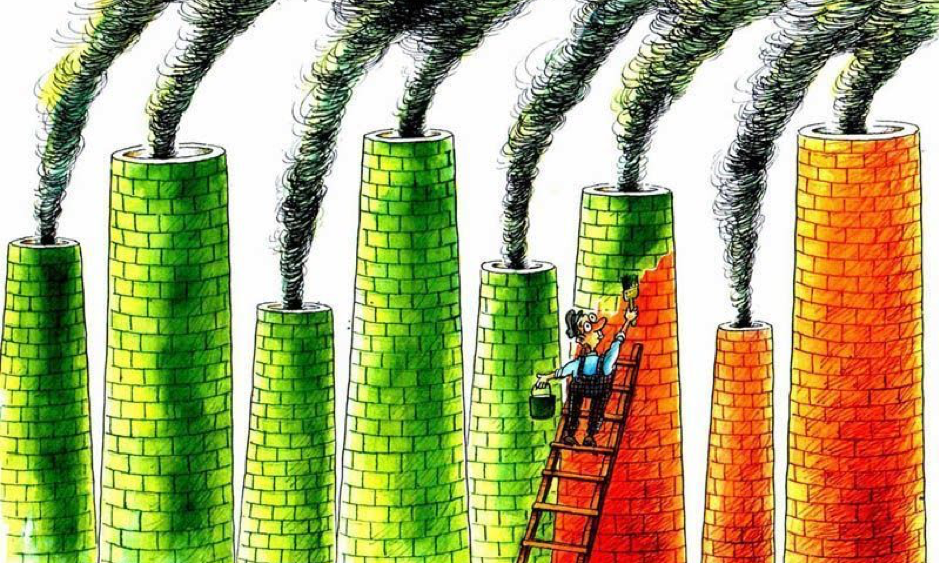

At its core, the contention behind the ESG debate was its lack of substantive definition and consequently procedural understanding to prevent “greenwashing”. There have since been subsequent calls for policy intervention to create threshold standards on what should qualify as an ESG investment, especially as the private sector has been increasingly showing an inability to do so. Meanwhile the World Bank has been fashioning quantitative measurements on the extent to which an ESG investment can be considered as such. The author argues here that this is a clear illustration of the need for a policy integration approach.

ESG investments are clearly an embodiment of the green growth mentality and its remarkable lack of accountability was very generous in its contributions to the mounting momentum to rid of such a classification entirely. It also adds to the argument that perhaps attempting to categorically pair environmental justice with economic growth is dead upon arrival. However, the author argues that the extent to which ESG was able to mobilize financial resources from and for both multinational corporations like Apple (which raised EUR 2bn through green bond sales) and small- to medium-sized enterprises, which to some extent have dedicated their infrastructures to advancing, at least nominally, the SDGs. Rather than seeking to eliminate a partially working system entirely, it would be more impactful to attempt to refine its machinery.

The United Nations has been seeking to do this through the Principles on Responsible Investment (PRI), which seek to provide more well developed “screens” to test the type of investments that qualify for classification as a responsible investment. The PRI engages the private sector in order to help shape a steady-state policy integration understanding of investment through ESG incorporation. This involves “explicitly and systematically including ESG issues in investment analysis”, though it does not evade persistent challenges to harmonized standards concerning ESG, which shall undoubtedly face the insufferable problem of a lack of uniformity in country and economic contexts. Furthermore, these initiatives, which certainly attempt to integrate policy in economic growth and sustainable development, also fall prey to the challenges raised by the limitations of green growth. Both portfolio and foreign direct investment are attracted by the promise of returns to investments. Economies that lack sufficiently attractive assets to investors or have countervailing factors may very much be susceptible to widening disparity gaps having been excluded from the surge in ESG. For instance, a country with traditional governance structures with strict social practices determined irresponsible within the determinations of ESG but with exemplary environmental stewardship shall indubitably face difficulties in ESG classification.

Should one travel further down to the philosophical kernel of this argument, it comes down to the classic question of laissez-faire. A policy integration and co-benefit approach will face the challenge of rescuing a positive trend in financing the SDGs while not crowding out the private sector with over-burdensome regulatory involvement.

The views expressed in this publication are those of the author’s and do not necessarily reflect the views of any institution.